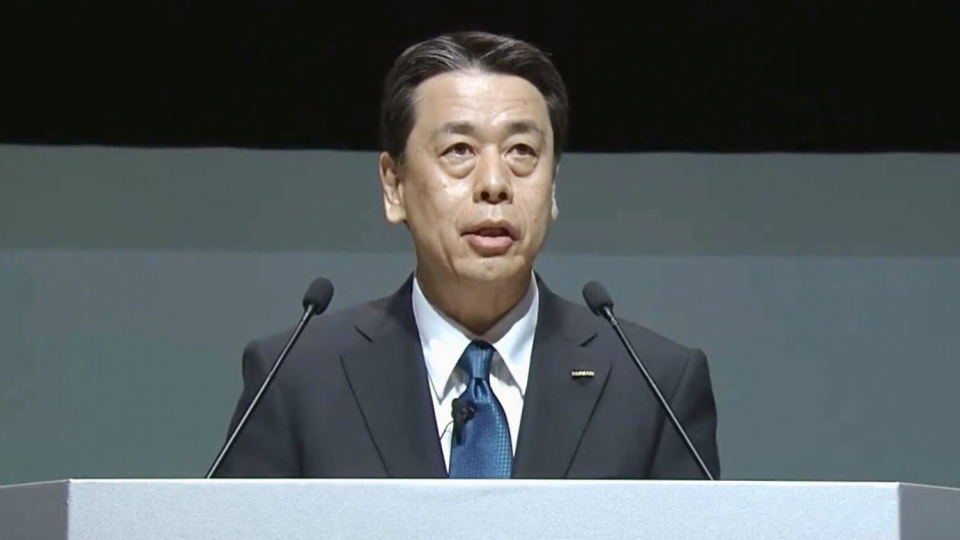

Nissan Motor Co. CEO Makoto Uchida apologized to disgruntled shareholders Monday for massive losses and foregoing a fiscal 2019 year-end dividend payment, vowing to put the struggling automaker back on a "growth path" through restructuring and focusing on core markets and technologies.

"Nissan will reorganize excess assets and sustainably pour in resources into our core markets" of North America, China and Japan, Uchida told a general shareholders' meeting. "By cutting fixed costs significantly, we will aim for a reliable recovery and steady growth."

Uchida was bombarded with harsh criticism from shareholders, who questioned the carmaker about its strategy to recover its share price, future dividend policy and earnings outlook.

One shareholder said, "Nissan will disappear in two years if it goes on like this. It needs strong leadership." Another said, "What Nissan still lacks the most is trust among consumers and the public" following the arrest of former boss Carlos Ghosn in 2018 over financial misconduct.

Nissan fell into a loss of 671.22 billion yen ($6.27 billion) in the fiscal year ended March, its first full-year red ink in 11 years, as years of expansion pursued by ousted boss Ghosn hit profitability and the coronavirus pandemic dealt a further blow to sagging global vehicle sales.

The red ink neared the scale of its 684.36 billion yen loss in fiscal 1999, when Ghosn was sent from Renault SA of France to rescue the Japanese automaker from the brink of bankruptcy.

For fiscal 2019, the automaker also booked around 600 billion yen in restructuring efforts, including the planned closure of plants in Indonesia and Barcelona and a reduction in its global workforce.

It also said it will cut annual production capacity by 20 percent to around 5.4 million vehicles from 7.2 million in fiscal 2018. In fiscal 2019, its global vehicle sales fell 10.6 percent to 4.93 million units.

Nissan's share price has plunged from above 1,000 yen since Ghosn's arrest in November 2018, hitting as low as 311.2 yen on April 6.

Related coverage:

FOCUS: Nissan falls behind rivals in industry's critical transition period