Japan is monitoring foreign exchange moves with a sense of urgency and will consider "all options available" if yen moves become volatile, the country's top currency diplomat, Masato Kanda, said Friday after the Japanese unit plunged relative to the U.S. dollar.

The dollar jumped by more than 1.5 yen in about an hour Friday, edging close to the 142 yen line at one point, as market participants apparently pared back expectations of a policy tweak by the Bank of Japan at the July 27-28 meeting on media reports the central bank would stand pat on policy.

Reuters reported Friday that the BOJ will likely keep its yield curve control program unchanged next week, citing sources familiar with its thinking. Bloomberg also reported that BOJ officials see little urgent need to address the program's side effects for now.

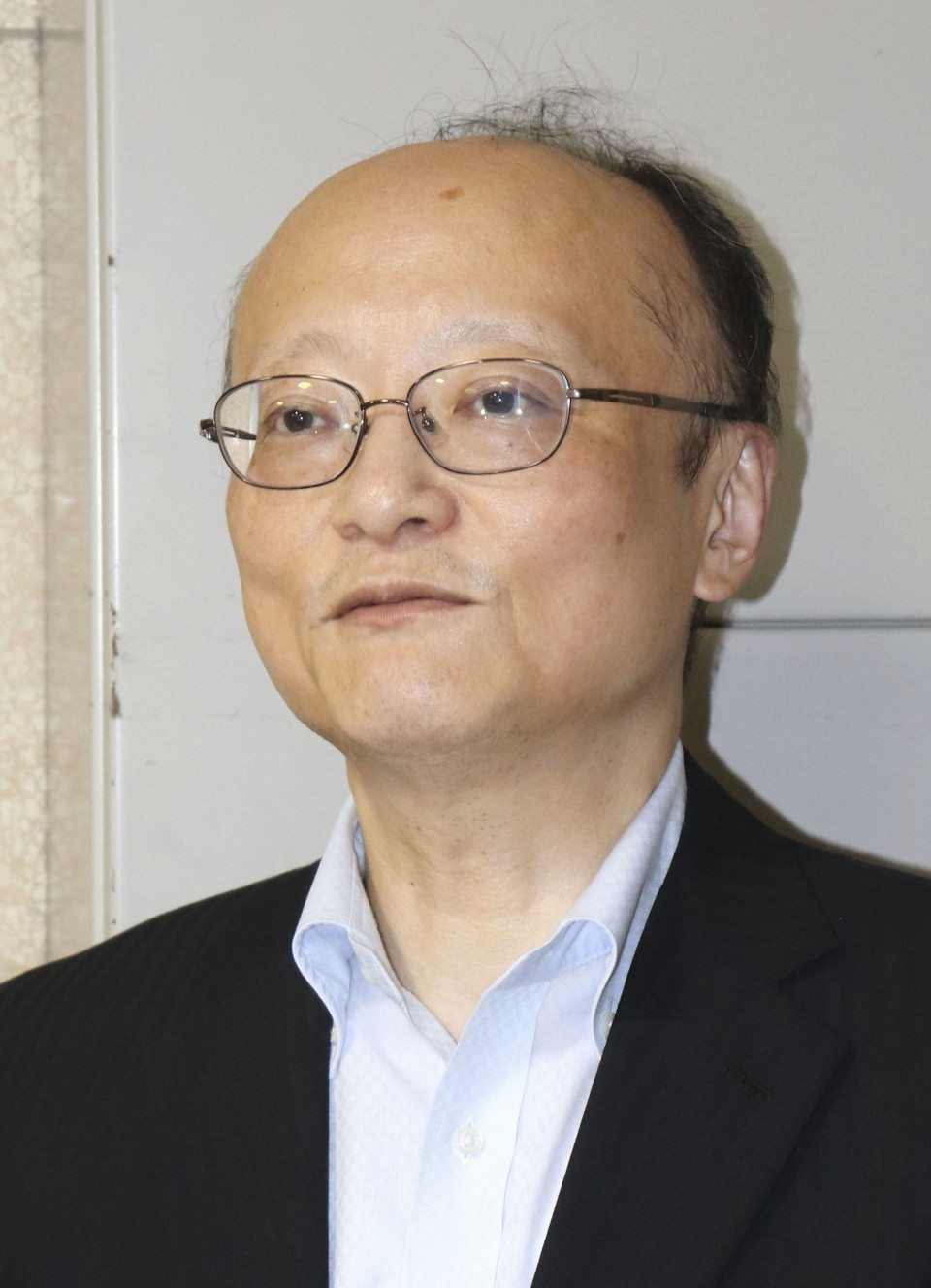

"We are closely watching developments with a sense of urgency," Kanda, vice finance minister for international affairs, told reporters.

Asked how Japanese authorities will respond to further rapid yen weakening, Kanda said, "We will consider all options available."

Japanese authorities issue verbal warnings when currency moves are rapid and volatile. Kanda made similar remarks before Japan intervened in the currency market on multiple occasions in September and October to arrest the yen's "rapid and one-sided" depreciation against the dollar.

Financial markets have been on edge over whether the BOJ would tweak its ultralow rate policy as Japan's inflation, at least on the surface, has been above the central bank's 2 percent target for over a year.

Japan's core consumer prices, excluding volatile fresh food items, rose 3.3 percent in June from a year earlier, staying above 2 percent for the 15th straight month, according to government data released earlier in the day.

The BOJ has been deeply committed to its ultraeasy monetary policy to achieve stable inflation and sustainable wage growth.

Under the yield curve control program, blamed for distorting bond markets, the BOJ has set short-term interest rates at minus 0.1 percent, and the upper cap on 10-year Japanese government bond yields at 0.5 percent.

Related coverage:

Japan posts 1st trade surplus in nearly 2 yrs in June

Japan monitoring forex moves extremely closely: finance chief