Japan and South Korea agreed Thursday to revive an emergency-use currency swap agreement that expired eight years ago, in a symbolic thaw in bilateral ties long frayed over wartime history.

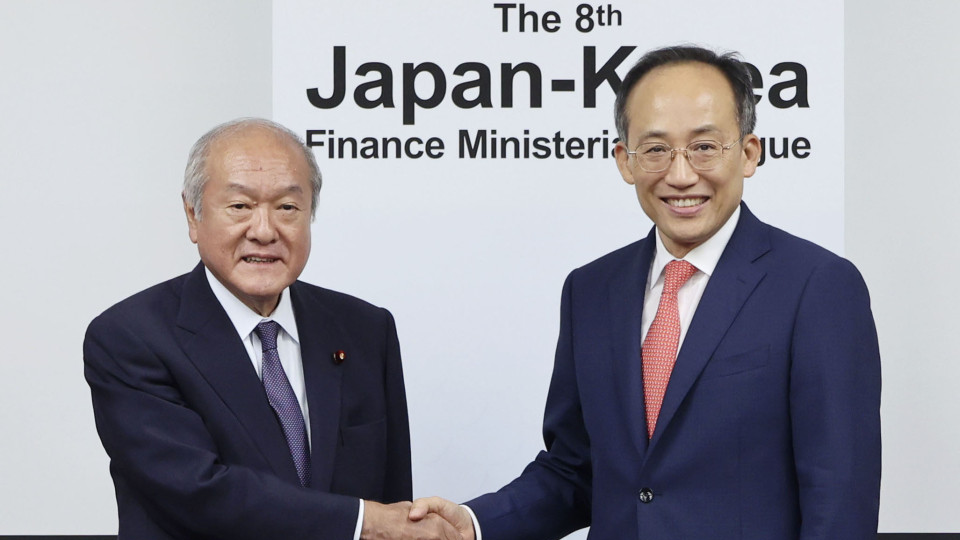

Finance Minister Shunichi Suzuki and his South Korean counterpart Choo Kyung Ho reached agreement during the first finance dialogue held since 2016 as bilateral efforts to mend ties have spread to the economic and financial fronts.

The $10 billion currency swap arrangement will ensure access to the U.S. dollar in times of emergency by exchanging the yen or the won.

The previous one ended in 2015 and was not renewed amid friction over South Korea-controlled, Japan-claimed islets in the Sea of Japan and the long-standing issue of comfort women forced to work in Japanese wartime military brothels.

"Japan and South Korea are neighbors, and we should cooperate in various fields," Suzuki said at a press conference after the meeting, noting that confidence has been building among the finance authorities.

While both nations have sufficient foreign reserves, having a swap agreement in place for emergencies will be "a plus for the yen and the won," Suzuki said.

South Korea possesses foreign reserves that amount to approximately one-third of Japan's reserves, which stand at roughly $1.2 trillion. The won and the yen have borne the brunt of the dollar's relative strength, partly due to the assertive interest rate hikes implemented by the U.S. Federal Reserve.

The first currency swap arrangement between Japan and South Korea dates back to 2001, in the aftermath of the Asian financial crisis.

Toru Nishihama, chief economist at Dai-ichi Life Research Institute, said the swap agreement would bring more benefits to South Korea than to Japan. "It would serve as a buffer, limiting spillovers (of financial concerns) to other regional economies, which is a plus from Japan's perspective, too," he added.

Under Yoon Suk Yeol, who became South Korea's president in 2022, bilateral ties have begun to gradually improve after he proposed a solution to the long-standing issue of wartime labor compensation that had sent Seoul-Tokyo ties to their lowest point in years.

When Suzuki and Choo met in South Korea in May, they agreed to resume the finance dialogue. The framework involves senior officials from both nations discussing economic and financial issues.

"The resumption of the finance dialogue symbolizes that normalization of ties, prompted by our leaders' summit, is spreading fully" to the economic and financial fields, Choo said at Thursday's meeting.

The finance chiefs agreed to work toward the early launch of a multilateral framework for resilient and inclusive supply-chain enhancement, as envisaged by the Group of Seven and partner nations.

The initiative is aimed at helping low- and middle-income countries assume more significant roles in the supply chains for critical items for decarbonization.

The Japan Bank for International Cooperation and the Export-Import Bank of Korean signed Thursday a memorandum of understanding to promote projects to build quality infrastructure in third countries, particularly in the Indo-Pacific, where China's clout is growing.

As Japan and South Korea, both U.S. allies, share common threats from nuclear-armed North Korea, the finance ministers said they will jointly address the issue of "proliferation financing" that would benefit the North in its manufacturing, possession and use of nuclear and other weapons.

Prime Minister Fumio Kishida visited South Korea in May, becoming the first Japanese leader in over five years to do so. Japan on Tuesday formally decided to relist South Korea as a preferred trade partner on July 21 in a reciprocal move after Seoul similarly changed Tokyo's status.

During the peak of bilateral tensions, Japan implemented export controls on crucial materials utilized in semiconductor manufacturing. However, those measures have already been lifted.

The deepening of ties between Japan and South Korea and a reduction in their reliance on China is reasonable in terms of "de-risking," Nishihama of Dai-ichi Life said.

"How far they will go remains to be seen. Tokyo-Seoul ties are improving but it will be naive to expect there will be no hiccups," he added.

The next bilateral finance dialogue will be held in South Korea next year.

Related coverage:

Every option on table to counter excess forex moves: Japan minister

Bank of Japan chief defends monetary easing as yen keeps weakening

Japan currency diplomat warns of action against excessive forex moves