Finance ministers from the Group of Seven industrialized nations started a two-day in-person meeting on Friday in London focusing on the introduction of a global minimum corporate tax rate.

Aside from the tax issue, "continuing support for vulnerable countries" amid the global economic recovery from the impact of the coronavirus pandemic and "joint action to ensure tackling climate change" are also among the agenda items, the British government said in a press release on Thursday.

A statement is expected to be released on Saturday after the first face-to-face talks among the G-7 finance chiefs since 2019 are concluded, according to Japanese government sources.

The gathering comes as discussion on a common minimum tax rate for companies that operate globally has been picking up momentum following a recent U.S. proposal to prevent them effectively avoiding tax by utilizing low-tax jurisdictions.

The U.S. Treasury Department said last month it proposed setting a minimum corporate tax rate of at least 15 percent globally during a meeting of an Organization for Economic Cooperation and Development steering group dealing with international tax issues. The move came as Washington seeks to raise domestic corporate levies.

The discussion on a universal lower limit for the tax rate is part of the multinational negotiations under a project led by the OECD and the Group of 20 major economies. It involves about 140 countries, which the OECD says aim to reach a "successful conclusion by mid-2021."

The project members have also been discussing rules to enable governments to tax global tech giants offering digital services such as Google LLC and Apple Inc. based on their sales even though they are not physically present in their countries.

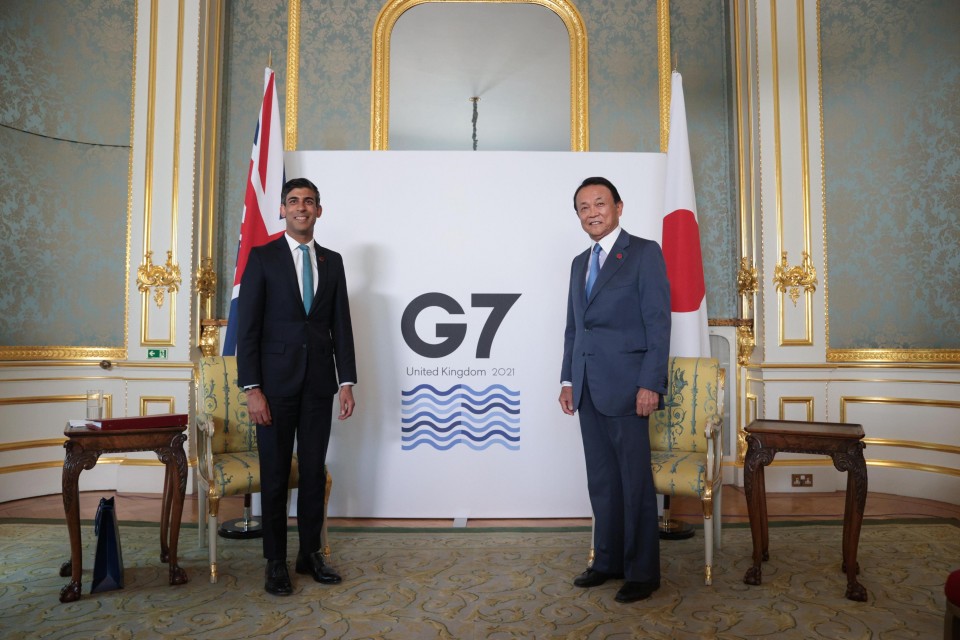

"Securing a global agreement on digital taxation has also been a key priority this year -- we want companies to pay the right amount of tax in the right place, and I hope we can reach a fair deal with our partners," said British Chancellor of the Exchequer Rishi Sunak, who presides over the London meeting.

The finance ministers are also expected to reaffirm continued cooperation toward a balanced economic recovery from the pandemic, since insufficient COVID-19 vaccine supply in developing countries threatens to slow their recovery.

The G-7 nations will aim to agree on steps to tackle climate change. These could include urging corporate efforts to curb greenhouse gas emissions and demanding major firms disclose estimates of how global warming will impact their operations.

Sunak is set to push his counterparts to follow Britain's lead in making climate risk reporting in the financial system mandatory, according to the British government.

Ahead of the G-7 talks, Japanese Finance Minister Taro Aso met Sunak on Thursday, and U.S. Treasury Secretary Janet Yellen on Friday. Sunak and Aso had "productive talks on tackling climate change and supporting global debt transparency," according to the chancellor.

The leaders of Britain, Canada, France, Germany, Italy, Japan and the United States plus the European Union are scheduled to hold a three-day in-person G-7 summit from June 11 in Cornwall, southwestern England.