Japanese flea market app operator Mercari Inc. made a strong debut on the Tokyo stock market Tuesday in the largest initial public offering so far this year in Japan, rising to a daily limit high after opening at a price far above the IPO price.

Mercari shares briefly surged to an upper limit for the day of 6,000 yen, twice its IPO price of 3,000 yen, before ending the first trading day on the Tokyo Stock Exchange's Mothers market for start-ups at 5,300 yen.

The highest price for the day lifted the market capitalization of the online marketplace operator to 811.9 billion yen ($7.3 billion). Based on the closing price, the company's value stood at 717.2 billion yen.

It took more than two hours after the market opened to get an initial price of 5,000 yen, 66.7 percent higher than the IPO price, with a glut of buy orders reflecting strong demand from investors.

The company's stock lost steam later in the day with some traders selling to lock in gains, but it remained above the opening price most of the day, supported by expectations of further growth potential.

"We'd like to create a global marketplace which produces new value," Mercari Chief Executive Officer Shintaro Yamada said at a press conference after the market closed.

The company tapped into the U.S. market in 2014 as a first step to go global and is stepping up efforts to bolster the business there by using the funds gained through the IPO.

"Our mission as a tech company is to bridge users all over the world through our service," said Yamada, adding that the company will focus on "the global market which is more than 10 times larger than the domestic market."

Mercari, which has been one of Japan's rare "unicorns" -- an unlisted start-up valued at more than $1 billion -- raised 63 billion yen through the issuance of 21 million new shares.

"Mercari's successful debut had positive effects on the market as investors who had hoarded the company's shares at the IPO price and locked in gains at a higher price would reinvest in other stocks," said Mitsuo Shimizu, equity strategist at Japan Asia Securities Co.

"The outlook for the company's stock price will depend on how it maintains its advantages in the fiercely competitive IT business environment," Shimizu added.

Mercari incurred a consolidated net loss of 4.2 billion yen in the year that ended in June last year following a loss of 348 million yen the previous year. Revenue rose to 22.1 billion yen from 12.3 billion yen.

The company expects revenue to rise 62.2 percent to 35.8 billion yen in the current year ending this month from a year earlier.

"At the current growth pace, I believe our U.S. business is set to become profitable," Yamada told reporters. The company released no projections on operating and net basis for this fiscal year.

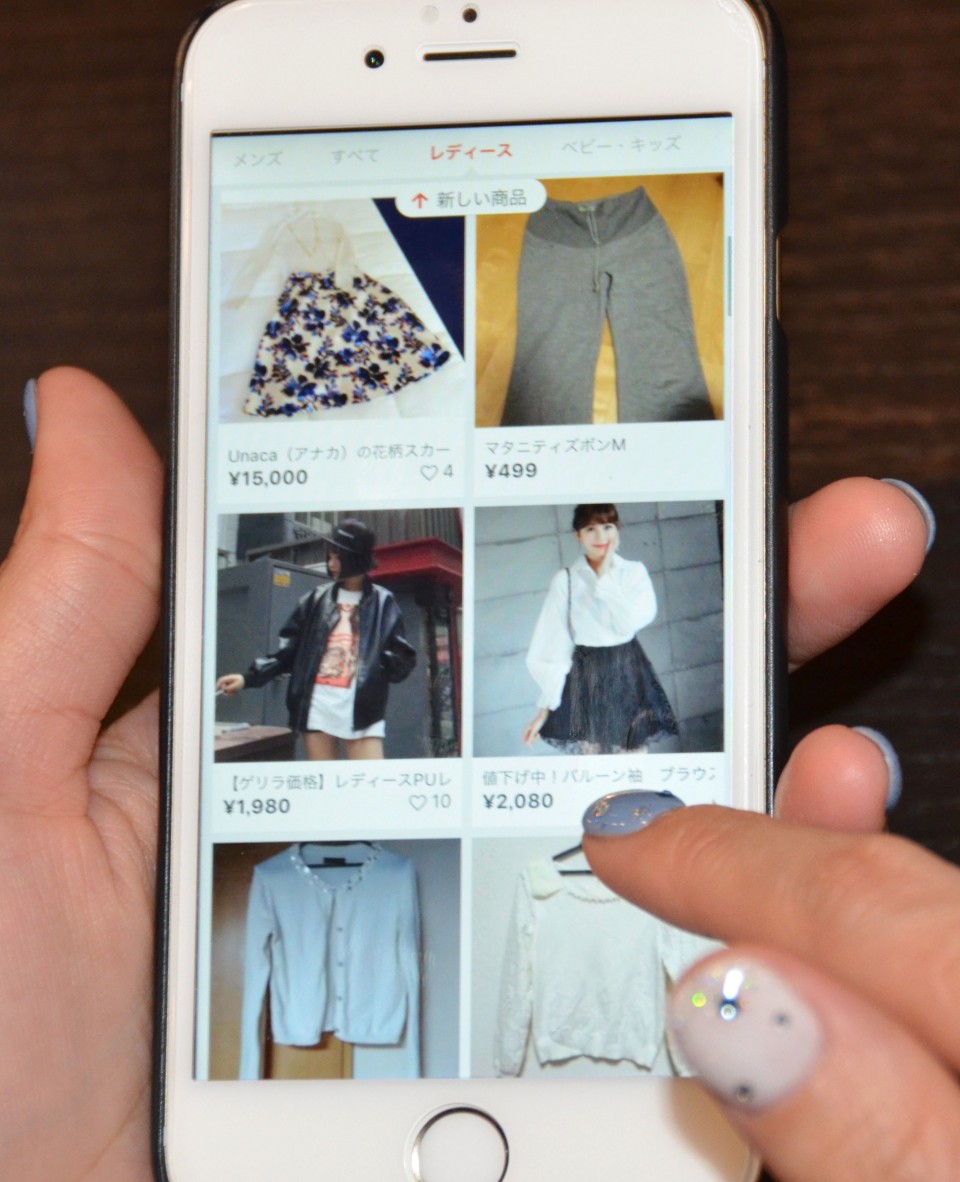

Established in 2013, the company with 1,000 employees operates a smartphone app that allows individuals to buy and sell used clothing and other items easily.

Its app was downloaded by more than 108 million smartphones in Japan, the United States and Britain as of March, the company said. The start-up has recently expanded its business, launching a bicycle-sharing service named Merchari in the western Japan city of Fukuoka while setting up an online settlement servicer called Merpay.

While the smartphone marketplace has gained popularity in Japan, the company hit a snag when some inappropriate items including stolen goods were sold through its app. Mercari has been toughening rules by reinforcing user identity checks.

Japan's telecommunications giant Softbank Group Corp. said in February it was considering listing shares of its mobile phone unit Softbank Corp. "within one year."

If realized, the mobile phone subsidiary would topple Mercari's IPO in size and possibly rival Japan's largest-ever IPO, the 1987 listing of Nippon Telegraph and Telephone Corp. for some 2.2 trillion yen.